does california have an estate tax or inheritance tax

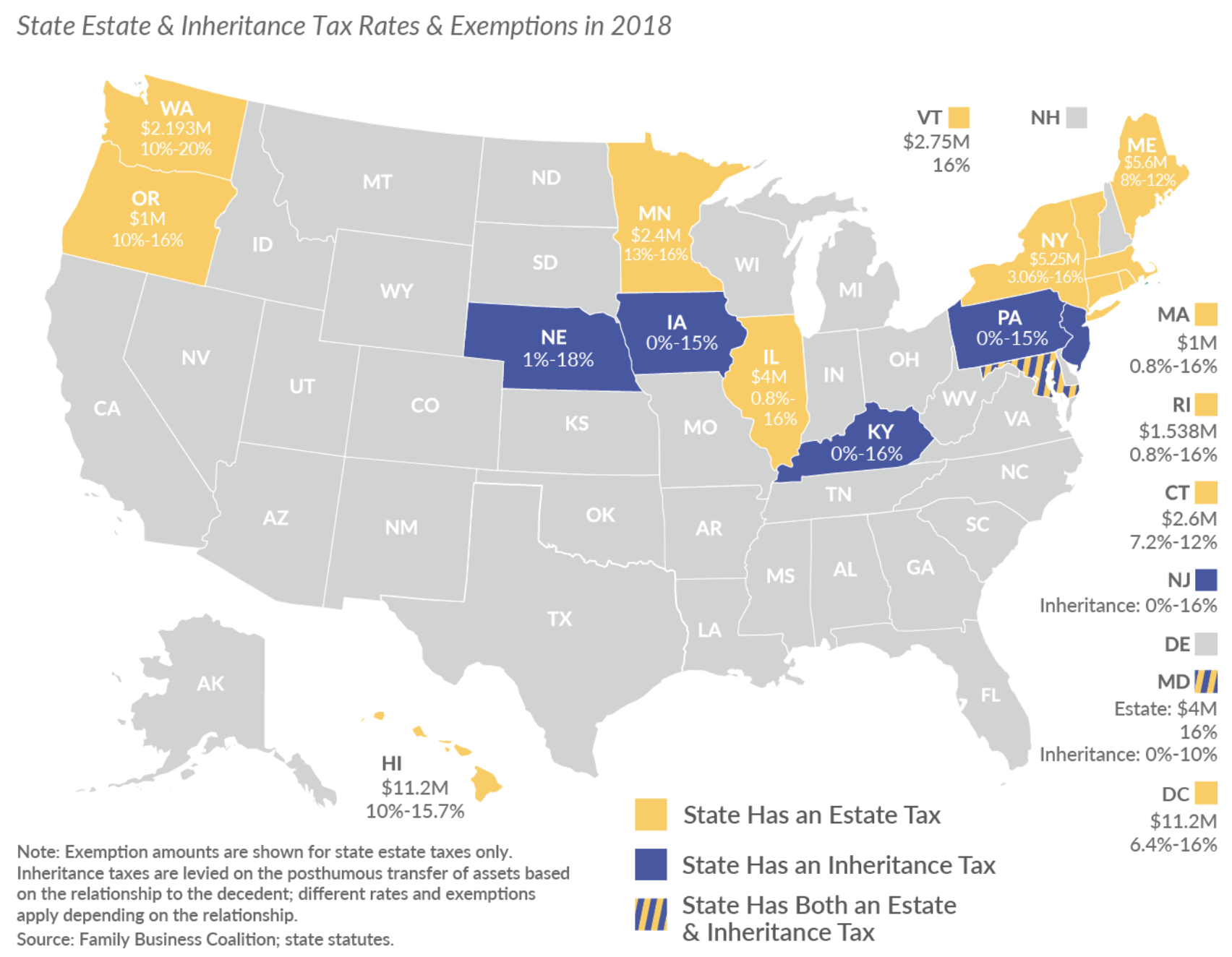

In fact just six states do Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Twelve states and the District of Columbia impose an estate tax while six states have an inheritance tax.

California S Tax On Inherited Properties Hurts Minority Communities Calmatters

The heirs and beneficiaries inherit the property free of tax.

. Delaware repealed its estate tax at the beginning of 2018. States California doesnt have an inheritance tax meaning that if youre a beneficiary you wont have to pay tax on your inheritance. California is one of the 38 states that does not have an estate tax.

However it is fair to recommend some patience for the process to get completed. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year. California Legislators Repealed the State Inheritance Tax in 1981 California previously did have what was called an inheritance tax which acted similar to an estate tax the primary difference being that the tax was levied on the person receiving an inheritance as opposed to an estate tax which is levied against the estate itself before property is distributed to beneficiaries.

Inheritance taxes where they apply are levied on a personal level after the estate has been distributed. No California estate tax means you get to keep more of your inheritance. There is a federal tax but this only applies to a single person estate valued at 549 million or above and 11 million or.

California does not have either one of these taxes which is why a living trust or revocable trust works perfectly in California and protects your beneficiaries from having to pay a tax on your estate upon receipt. California also does not have an inheritance tax. Delaware repealed its estate tax at the beginning of 2018.

However the federal gift tax does still apply to residents of California. If someone dies in California with less than the exemption amount their estate doesnt owe any federal estate tax and there is no California inheritance tax. Individuals unrelated to a deceased person however tend to be subject to inheritance tax.

Idaho also does not have an inheritance tax. While an estate tax is charged against the deceased persons estate regardless of who inherits what states with an inheritance tax assess it on the beneficiary. New Jersey finished phasing out its estate tax at the same time and now only imposes an inheritance tax.

The state with the highest maximum estate tax rate is Washington 20 percent followed by. Like most US. They dont pay income tax on it either because inherited property is not ordinary income.

Washington states 20 percent rate is the highest estate tax rate in the nation. Inheritance Tax In California. For 2021 the annual gift-tax exclusion is 15000 per donor per recipient.

Currently fourteen states and the District of Columbia impose an estate tax while six states have an inheritance tax. Maryland and New Jersey have both. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax.

Thats why planning out your estate ahead of time is of paramount concern. That being said California does not have an inheritance tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as estate taxes without the federal exemption hurt a states competitiveness.

For most individuals in California People who are starting the estate planning process often wonder about the potential estate or inheritance tax implications. The California Inheritance Tax and Gift Tax As I previously mentioned there is no inheritance tax in California regardless of net worth. That is not true in every state.

If you think youll need help with estate planning a financial advisor could advise you on reaching your goals. California does not levy a gift tax. People often use the terms estate tax and inheritance tax interchangeably when in fact they are distinct types of taxation.

Of course this applies to California. And although a deceased individuals estate is usually responsible for the payment of estate taxes a decedents beneficiaries are responsible for the payment of inheritance taxes. Call today for an Initial Consultation.

As of 2021 12 states plus the District of Columbia impose an estate tax. This is huge for my California financial-planning clients. Idaho does not currently impose an inheritance tax.

Taxes are due when inherited assets are distributed from a traditional account. For decedents that die on or after June 8 1982 and before January 1 2005 a California Estate Tax Return is required to be filed with the State Controllers Office if. Some states have enacted inheritance taxes on estates of any size.

There really is no tax that would be chargeable to you as a beneficiary for receiving an inheritance. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as estate taxes without the federal exemption hurt a states competitiveness. However California is not among them.

With the exception of the estate tax for estates exceeding 1158 million dollars per person California does not have a state-level inheritance tax. There are no estate or inheritance taxes in California. Some states have a state-level inheritance tax requiring that you have to pay a tax on what you receive as an inheritance.

Unlike cash and other inheritance 401ks dont follow the typical guidelines of the estate tax. Does California Impose an Inheritance Tax. Thats not true in every state.

For decedents that die on or after January 1 2005 there is no longer a requirement to file a California Estate Tax Return. The information below summarizes the filing requirements for Estate Inheritance andor Gift Tax. California does not have an estate tax so probate is generally spent verifying the validity of the will and confirming who will act as executor of the estate.

California inheritance laws especially when there isnt a valid will in place can get a bit convoluted. For most individuals in California this is no longer a major concern. Eight states and DC are next with a top rate of 16 percent.

In addition to the federal estate tax of 40 percent which is Facts Figures. Maryland is the only state in the country to impose both. In California we do not have a state level inheritance tax.

However there are other taxes that may apply to your wealth and property after you die.

Estate Tax Examples Of Estate Tax Estate Tax Rate

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Is Inheritance Taxable In California California Trust Estate Probate Litigation

Is Inheritance Taxable In California California Trust Estate Probate Litigation

The Estate Tax On Stocks And Dividends Intelligent Income By Simply Safe Dividends

What Is An Estate Tax Napkin Finance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Taxes On Your Inheritance In California Albertson Davidson Llp

States With No Estate Tax Or Inheritance Tax Plan Where You Die

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

How Much Is Inheritance Tax Community Tax

What Is An Estate Tax Napkin Finance

How Do State Estate And Inheritance Taxes Work Tax Policy Center

How Is Tax Liability Calculated Common Tax Questions Answered

How Much Is Inheritance Tax Community Tax

How Could We Reform The Estate Tax Tax Policy Center

The Property Tax Inheritance Exclusion

Opportunities And Pitfalls For Foreign Inheritances And Beneficiaries Advisor S Edge